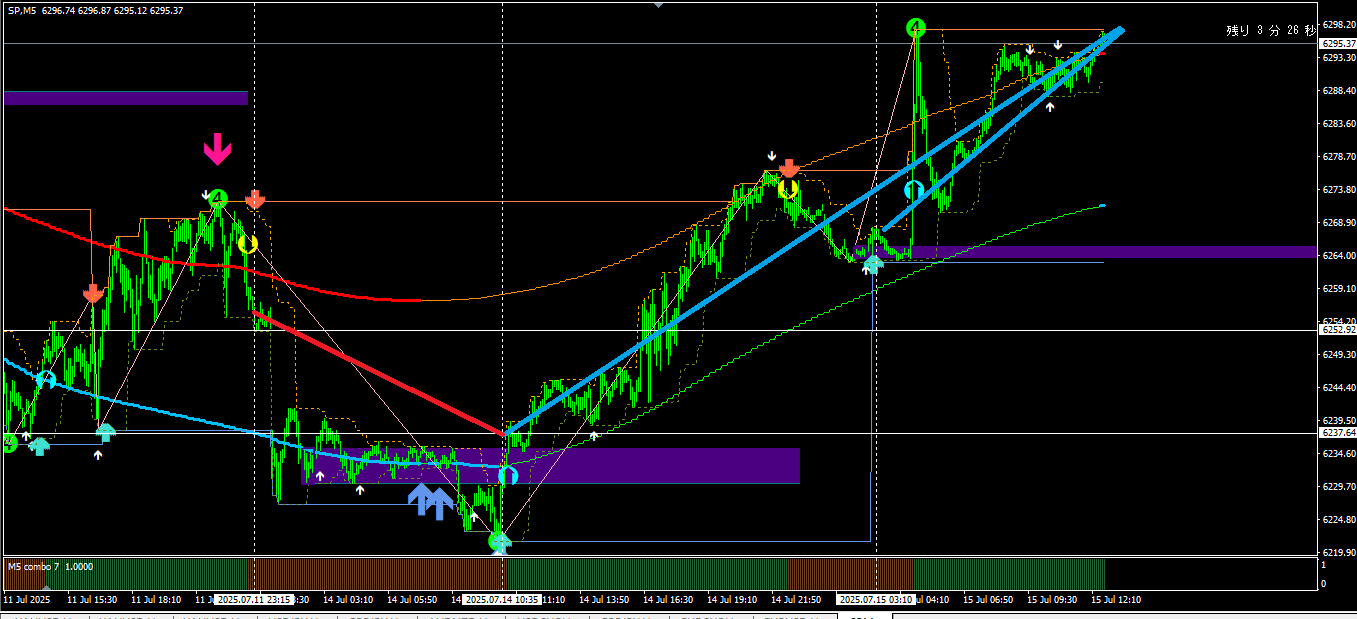

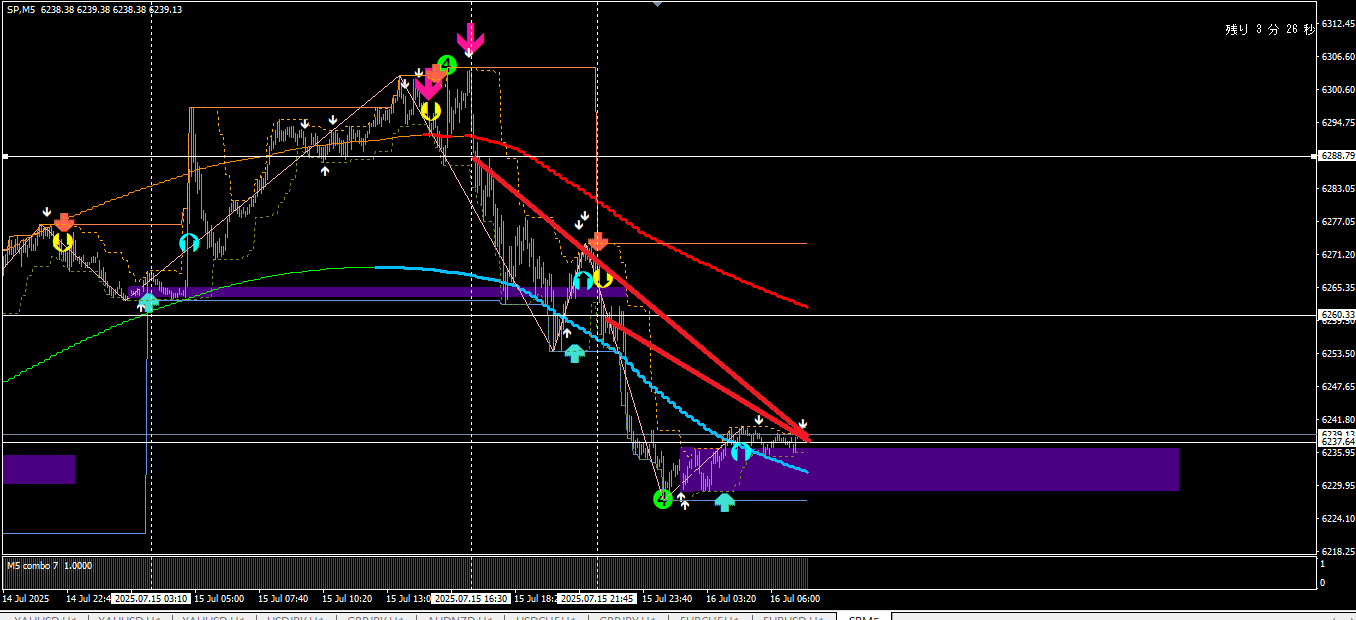

S&P500 0715

-

Resilient U.S. Economy

- Solid jobs data: Nonfarm payrolls for June increased by 147,000, beating expectations, and the unemployment rate improved to 4.1%.

- Stable consumer spending: Americans continue to spend steadily, helping support corporate earnings and dampening recession fears.

- Recovery in manufacturing data: Indicators like the ISM Manufacturing Index show signs of improvement, contributing to economic optimism.

-

Strong Tech Sector Performance

- NVIDIA leads the charge: Fueled by AI demand, its stock hit a record high, pushing its market cap close to $4 trillion.

- Apple and chipmakers shine: Apple rose 6.2%, while Applied Materials and KLA Corporation gained around 3–4%.

- AI boom boosts investment: The generative AI wave continues to attract capital, driving a 2.44% gain in the S&P 500 Technology Index.

-

Rate Cut Expectations

- Fed easing outlook: With inflation cooling and a healthy labor market, markets anticipate interest rate cuts later this year.

- Lower rates = stock appeal: A low-rate environment makes equities more attractive, especially growth stocks.

- Fed communications: Investors interpret Jerome Powell’s remarks and FOMC minutes as cautiously optimistic, reinforcing hopes for easing.

- “The S&P 500 has shown impressive strength, though a short-term correction might be healthy at this point.”

- “In the short term, a correction phase is possible, but the prevailing view is that a long-term upward trend will continue. However, geopolitical risks and changes in interest rate policies should be closely monitored.Simply put, it’s the usual situation — I don’t know."

最近のコメント